Governor Kathy Hochul on Monday unveiled a proposal to expand New York's child tax credit, offering up to $1,000 per child under age four and $500 for children aged four to 16.

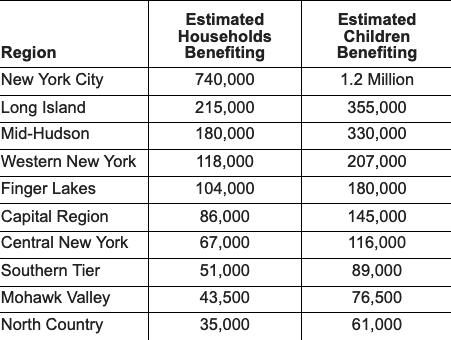

The plan, part of her 2025 State of the State agenda, aims to provide relief to 1.6 million families and more than 2.75 million children, marking the largest boost to the credit in state history, according to a press release.

“From groceries to strollers to kids’ clothes, the cost of living and raising a family is still too damn high - and that’s why we’re proposing a massive increase in New York’s child tax credit to put up to $1,000 per kid back in the pockets of hardworking families,” Hochul said. “As New York’s first mom governor, I know how hard it can be for parents to make ends meet - and I’ll never stop fighting to make New York more affordable for every family.”

Under the proposal, the average annual credit would nearly double from $472 to $943. Families with incomes up to $110,000 could receive full benefits, while those earning up to $170,000 would still qualify for partial credits. Currently, families can receive a maximum of $330 per child.

Hochul’s plan is projected to reduce child poverty statewide by 8.2% when fully implemented and by 17.7% when combined with other measures, such as expanded subsidized child care.

For example, a family of four earning $110,000 with a toddler and a school-age child would receive $1,500 annually, nearly $1,000 more than under the current system. A family of four earning $170,000 would receive over $500, which they would not have qualified for previously.

The phased rollout begins with the 2025 tax year, allowing families with children under four to claim up to $1,000. In 2026, families with older children will become eligible for up to $500 per child.