As the Feb. 28 expiration date for New York City’s controversial tax lien sale program looms with no replacement in sight, housing rights activists are taking matters into their own hands.

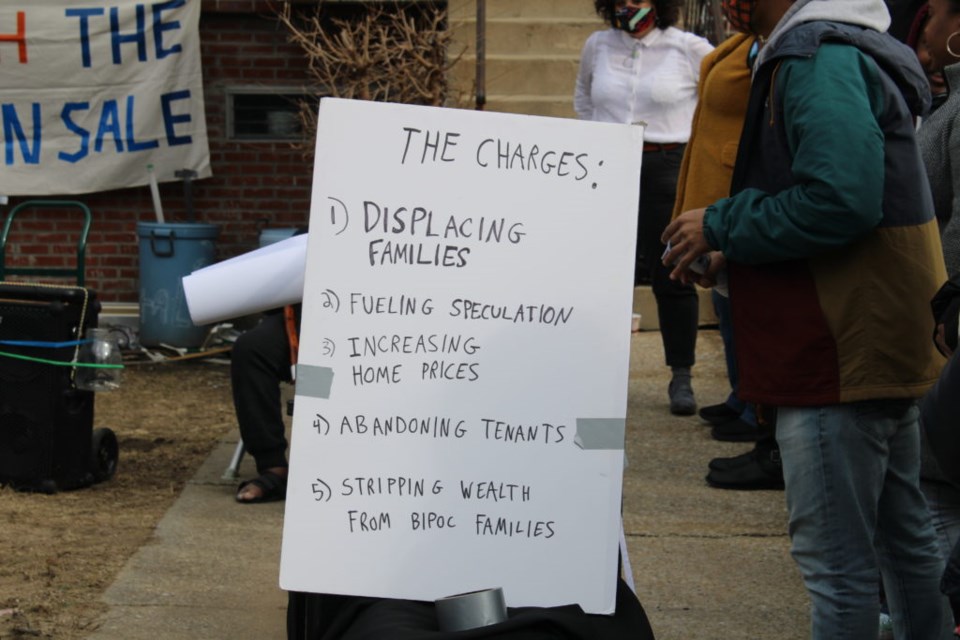

On Saturday, the Abolish NYC Tax Lien Sale Coalition, headed by the East New York Community Land Trust (ENYCLT), hosted a mock trial in East New York charging the tax lien sale with increasing home prices and stripping BIPOC families of generational wealth.

Around 60 onlookers gathered in front of East New York resident Marcus Tarver’s home; Tarver’s home was saved from being included in last year’s Tax Lien Sale due to efforts by the ENYCLT.

What is the tax lien sale?

The sale is an annual program, created by former Mayor Rudy Giuliani, to collect unpaid property taxes and water bills. When property owners fall behind on their taxes and receive liens, those liens are sold by the city to a private buyer in the annual sale, who does not take title to the property, but does purchase the right to collect the money owed plus interest and fees — ultimately multiplying the debt.

If the property owner does not pay, the lien holder may foreclose on the property and the building will be sold at auction.

Activists have long pointed out that the program disproportionately impacts homeowners of color, with the majority of liens sold in communities of color.

In December 2021, the City sold 2,841 liens, including the liens of 392 vacant lots that could have supported the development of an estimated 3,600 affordable housing units, ENYCLT Coordinator Hannah Anousheh told BK Reader at the time.

On trial by the community

Saturday's mock trial featured speeches on the impact of the sale by members of ENYCLT and it was attended by elected officials from across the city, including Councilmembers Sandy Nurse and Carlina Rivera, and District Leader Samy Nemir Olivares.

ENYCLT President Albert Scott presided over the event as the “judge,” and declared the sale was a “predatory system” currently designed as “a tool to displace, to strip away generational wealth, to simply abandon our tenants in their time of need.”

ENYCLT Secretary Debra Ack playfully acted as the sale’s defense in the trial. She later told BK Reader the aim was to entertain, while getting “the message across how harmful this tax lien sale is.”

Investing in community land trusts

The Abolish NYC Tax Lien Sale Coalition proposes a community land trust model as an alternative to the tax lien sale. Under this model, the coalition says homeowners would first be given the opportunity to go into a payment plan to pay off their debt, then be offered the opportunity to put their property in a community-run land trust. The proposed model emphasizes homeowners being able to stay in their homes at each step of the process.

“The whole idea of our model is to give people the support they need to make their payments to get out of debt. Then in the worst-case scenario, to always stay in their home,” Anousheh said.

Last fall, a 12-member task force was created to explore alternatives to the sale, but with no agreement made, it went on as planned in December.

Ack, who was a member of the task force, said ultimately it was a failure for not reaching consensus on a different way for the City to collect the taxes, “besides threatening to take people’s properties from them.”

“The only thing we ask is that the City work with us. Work with us on our alternative.”

Is the end near?

On Feb. 28, the legislation allowing for the sale will expire, effectively putting an end to it, but leaving room for new legislation to be introduced if no alternative is found.

“The fact is that the tax lien sale is a racial justice issue, particularly for Black homeowners in this area,” newly-elected Councilmember Sandy Nurse said.

“There's no reason that this needs to be renewed. There are plenty of recommendations that came from the Tax Lien Sale Task Force. And many of them were investing in community land trusts.”

Mayor Eric Adams publicly supported an end to the sale during his campaign last year, in his 2021 Housing Plan he states: “there is enough evidence that the annual lien sale has not been a just or an effective debt collection program. A real recovery is not balanced on the backs of the generational wealth in Black and Brown communities.”

But with the expiration date fast approaching, there is still uncertainty at City Hall on the future of the sale.

In a statement to BK Reader, a spokesperson for City Hall said: “Mayor Adams believes the City should explore alternatives to the current lien sale that ensure the city can continue collecting its debts while helping homeowners — particularly Black and Brown homeowners who have been disproportionately impacted by the pandemic — retain ownership.”

The Department of Finance declined to comment.

The Abolish NYC Tax Lien Sale Coalition is planning another rally at City Hall on Feb. 28.