Renting an apartment in New York City is about to get a little easier for tenants after the New York City Council passed the Fairness in Apartment Rental Expenses (FARE) Act, which will relieve them of broker fees from to landlords. Once enacted, this new law is expected to reduce the average upfront cost for renters by 41.8%, from $12,951 to $7,537, a report by StreetEasy has found.

StreetEasy is a real estate platform specializing in New York City, offering detailed property listings, market insights and tools for buyers, sellers and renters.

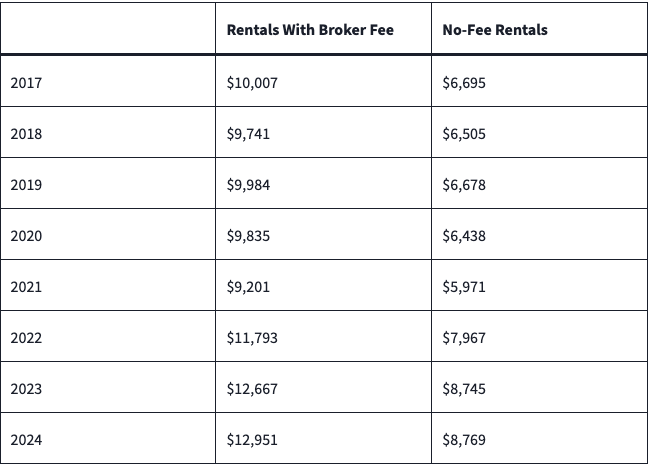

Under the current system, tenants cover broker fees — often equivalent to 12% of a year’s rent — along with the first month’s rent and a security deposit. This has pushed the average upfront cost for rentals with broker fees to an all-time high of $12,951 in 2024, a 29% increase since 2017.

This year, 46.8% of all NYC rentals charged broker fees, with 57.3% of rentals below the median asking rent requiring tenants to cover these costs, preventing tenants from moving, even to cheaper accommodation.

Once the FARE Act is enacted, landlords will be required to disclose any fees tenants might be responsible for. Advocates argue this transparency will empower renters to make informed decisions and encourage a more competitive and equitable housing market.

The legislation is not without critics who have suggested that shifting broker fees to landlords could drive up asking rents. However, the results from StreetEasy's analysis of rent trends between 2012 and 2024 found no significant rent increases for units that transitioned from tenant-paid to landlord-paid broker fees. In fact, rent growth for such units has generally aligned with broader market trends.

During the pandemic, properties that dropped broker fees experienced slower rent declines compared to those that retained them. More recently, between 2022 and 2024, units with tenant-paid broker fees saw faster rent increases, suggesting that high upfront costs have allowed landlords to raise rents more aggressively.

The FARE Act comes at a critical time for NYC’s rental market, which is grappling with a housing shortage and a 1.4% vacancy rate — the lowest since 1968. Advocates say reducing upfront costs will give renters the financial flexibility to move into homes that better meet their needs, alleviating the “lock-in” effect caused by prohibitive fees.

While the FARE Act is a major milestone, advocates believe more work is needed to address the city’s broader housing crisis. Zillow and StreetEasy are collaborating with policymakers to promote additional reforms, including easing zoning restrictions to increase housing supply and reducing other upfront costs like security deposits.