New York City homeowners will have the chance to voice questions and concerns about the controversial annual tax lien sale taking place in December at a public hearing on October 1, held by the city’s Tax Lien Sale Task Force.

The sale, which did not take place in 2020 due to the COVID-19 pandemic, could put over 11,000 property owners at risk of falling further into debt and or even facing foreclosure.

Held by the New York Departments of Finance and Environmental protection, the sale puts properties that are behind on property taxes or water and sewer bills up to auction. The buyers do not take ownership of the property, but instead purchases the right to collect the tax money owed plus interest and additional fees.

If the property owner continues to fall behind on payments the lien holder may foreclose, sending the property to auction. This year water and sewer debts are not included in the sale.

In the past, any property with over $1,000 in debt and was at least one year overdue was eligible for the lien sale, but this year the number has been pushed up to $5,000.

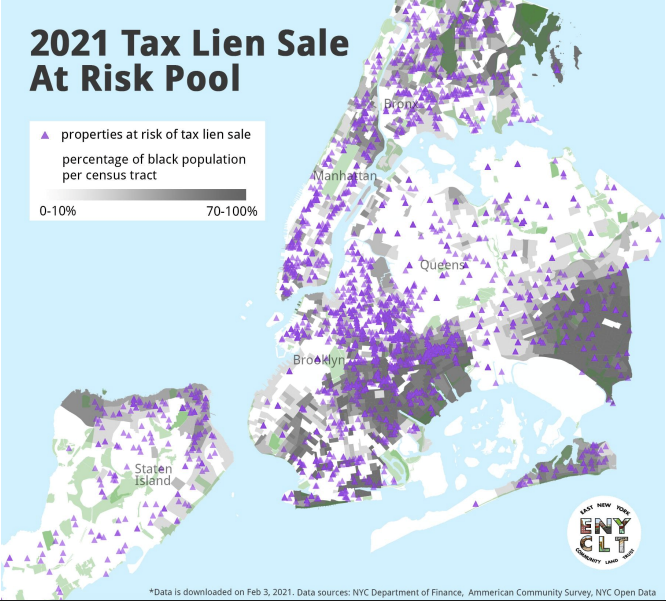

Historically, the tax lien sale has disproportionately affected Black New Yorkers and other people of color. According to a report by the Coalition for Affordable Homes, the city is six times as likely to sell a lien in majority Black neighborhoods than in a majority white neighborhood and twice as likely in a majority Hispanic neighborhood.

This year, people in danger of facing the tax lien sale can fill out a hardship exemption waiver if they have suffered from a loss of income in any form due to the pandemic.

With so many New Yorkers at risk, opposition to the tax lien sale has been vocal.

Community groups like the East New York Community Land Trust (ENYCLT) have been among the most vocal in advocating for a different system. They have facilitated the Abolish the NYC Tax Lien Sale Coalition, a citywide coalition of ten member organizations calling for not only the abolition of the tax lien sale, but also the development of an alternative system of tax collection that promotes neighborhood stability through supporting CLT’s.

“These ten organizations have come together to say, 'Stop riding the backs of the Black and Brown people in our community',” ENYCLT Board Secretary Debra Ack said at a recent information session hosted by the group.

“We need to preserve and save our homes by abolishing the tax lien sale.”

In addition to her work with ENYCLT, Ack was also recently appointed to the City’s Tax Lien Sale Task Force.

“It has not been easy fighting against government agencies when I’m the only community organizer, but I continue to be there to struggle for my people and to speak for my people,” she said.

The task force will be holding a virtual public meeting on October 1 at 1:00pm. Using comments and feedback from the meeting they will be putting forward a report for the city in November with recommendations for the future of the lien sale.

The tax lien sale will take place on December 17.