Despite mounting community and political opposition, the City has announced it will hold a tax lien sale this December, putting more than 11,000 NYC property owners at risk of falling further into debt.

The lien sale is held every year by the New York City Departments of Finance and Environmental Protection, where the tax liens on properties with unpaid property taxes and water bills are sold off in an auction.

The City sells the liens to a single authorized buyer, who does not take title to the property, but does purchase the right to collect the money owed plus interest and fees -- ultimately multiplying the debt.

If the property owner does not pay, the lien holder may foreclose on the property and the building will be sold at auction.

This year, the Department of Environmental Protection has opted out of the sale, which will only include Department of Finance held property tax liens, not water and sewer liens.

However, the reduced sale still includes 11,194 properties that have outstanding property tax and emergency repair payments that are past-due to the City. There are 3,657 one-to-three family homes, 3,295 apartment buildings and 4,242 other properties on the list.

Property owners have until Dec. 13 to pay off their debts, make a payment arrangement or submit a hardship declaration to the City to have their property removed from the list.

In 2020, Governor Andrew Cuomo halted the tax lien sale after 58 local, state and federal leaders urged the delay, and many called for further reform or abolition of the program saying that it largely impacted communities of color and had been responsible for displacement across city and statewide.

Community groups such as East New York Community Land Trust (ENYCLT) have been advocating for reform, arguing the sale pushes longtime tenants out of their homes. Albert Scott Jr., Trust President and lifelong East New York resident, told BK Reader the group was "extremely disturbed" that Mayor Bill de Blasio had decided to hold the lien sale this year while people continued to struggle with the effects of the pandemic.

"When people are already behind on their bills, the fees and interest that the private tax lien trust charges can easily put them over the brink," he said.

"The racialized impact of the tax lien sale is blatantly clear - communities like East New York are hit the hardest because of a long list of exclusionary policies including unfair lending practices, and the tax lien sale weaponizes this."

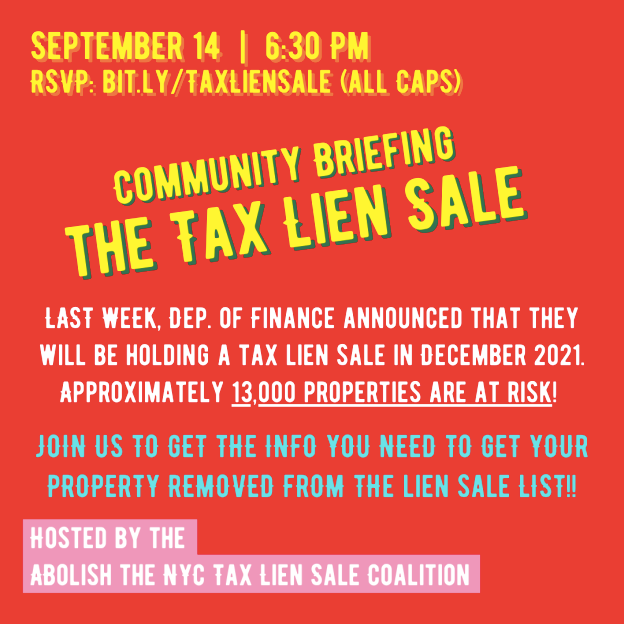

ENYCLT is one of the founding groups behind the The Abolish the Tax Lien Sale coalition, which will be holding an information session on the tax lien sale on September 14.

Due to the coalition's pressure, and mounting pressure from elected officials, the administration and City Council have formed a task force on the sale, which is currently investigating the process. The task force is due to release a draft report for public review on the tax lien sale process later this month, hold a hearing by October 1 and provide a final report to the City Council Speaker and the Mayor by November 1, 2021.

ENYCLT hopes the report will spell the end of the controversial auction.

Also because of community advocacy, DOF is now required to contract with community based organizations to do direct outreach in neighborhoods citywide. The outreach includes letting homeowners know how, by filling out a hardship declaration, they can stop the sale of liens on their properties.

Last year, New York Attorney General Letitia James called on Mayor Bill de Blasio and City Council Speaker Corey Johnson to reform the tax lien process, saying it needed to go from a process that "tears down neighborhoods to one that builds them up."

James said the terms imposed by the tax lien sale on New Yorkers were dramatic, including mandatory 5% surcharges, legal fees and a nine or 18% interest rate that compounds daily. She said the additional fees could quickly turn a relatively small tax lien into an overwhelming financial burden, eventually pushing homeowners into foreclosure.

She instead called for the use of community land trusts and land banks instead of an auction, adding that would keep residents in their homes and properties would be permanently secured as community assets.

James also urged the city to eliminate water and sewer lien sales for low- and middle-income homeowners of one-to-three family homes; create a "Homeowner Advocate" position who would help homeowners navigate different agencies involved in the tax lien sale; and exclude non-profits and houses of worship from both the water and the property tax lien sale.

To join The Abolish the Tax Lien Sale's community briefing being held on Sept. 14 from 6:30pm - 8:00pm, click here.