The Coronavirus Aid, Relief, and Economic Security Act, (the "CARES Act") S.3548, was signed into law on March 27, 2020.

The $2.2 trillion package outlines a series of provisions aimed at supplementing, increasing and expanding unemployment insurance (UI) benefits that former employees already or will receive. (See original bill here).

In other words, the government has passed a law that will provide additional work relief benefits through July 31, 2020, which is about 15-16 weeks, if you apply now. In short, whatever you are receiving or are due in UI relief from your job loss (in NYC, UI benefits max out at $504/week before taxes, which is about $440 after taxes), you will receive an additional $600/week.

Also, take note that there is also a new provision created called the Pandemic Unemployment Assistance (PUA). This provision provides $600/week for contractors, entrepreneurs, creatives, gig workers-- people who were not paying into UI benefits but who also lost work as a result of the job closings.

If you have not already started the process to receive this assistance, start it right now.

For more information to print, post and share, you may download this sheet (PDF).

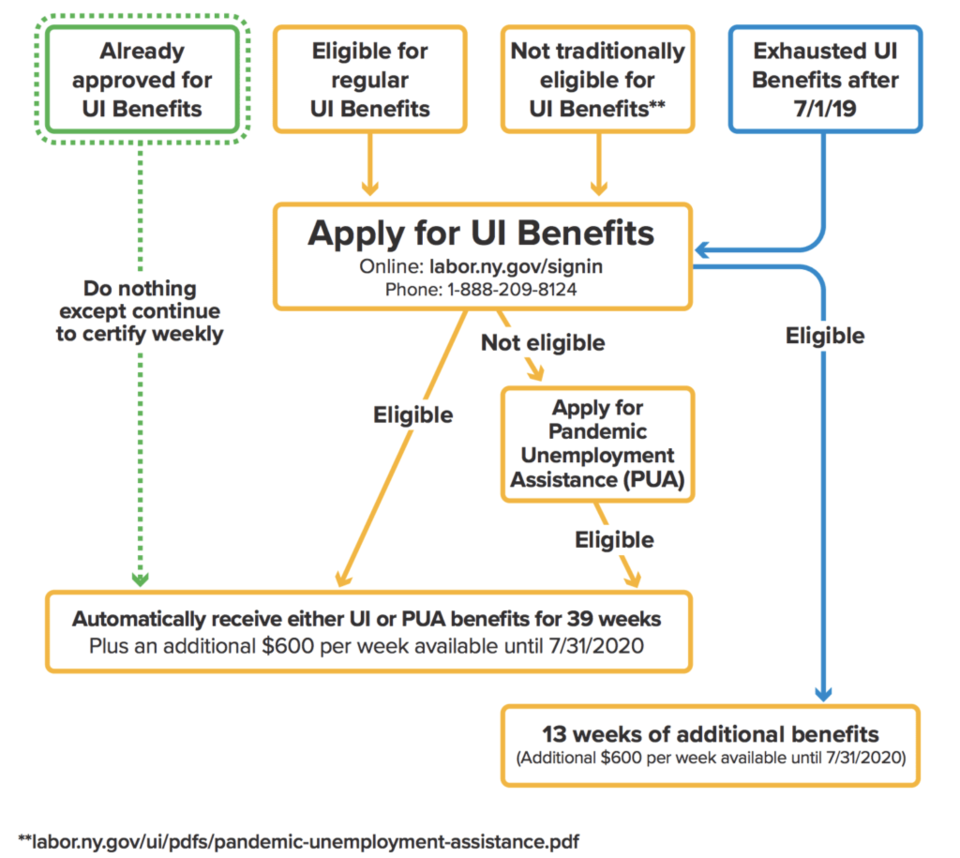

Also, see this below chart and step-by-step instructions.

If You Are Already Approved for UI Benefits:

What you should do:

- Do nothing except continue to certify weekly. Your benefits will be updated automatically.

(Please do not call; it will only make it difficult for others to reach an agent.)

What you may qualify to receive:

- 39 weeks of UI benefits.

- An additional $600/week until 7/31/2020.

(Payments begin 4/5/2020)

If You Are Filing a New UI Claim:

What you should do:

- Apply online at www.labor.ny.gov/signin.

What you may qualify to receive:

- 39 weeks of UI benefits.

- An additional $600/week until 7/31/2020.

(Payments begin 4/5/2020)

If You Are Not Traditionally Eligible for UI Benefits:

What you should do:

- Check your eligibility for PUA.

- If you believe you are eligible, apply online at www.labor.ny.gov/signin.

What you may qualify to receive:

- 39 weeks of PUA benefits.

- An additional $600/week until 7/31/2020.

(Payments begin 4/5/2020)

If You've Exhausted 26 Weeks of Benefits After 7/1/2019:

What you should do:

- Apply online at www.labor.ny.gov/signin.

What you may qualify to receive:

- 13 weeks of benefits.

- An additional $600/week until 7/31/2020.

(Payments begin 4/5/2020)