The report, based on a sample of tenants paying less than $2,000 a month, estimates that 76 percent of them would see their credit scores improve if their rental payments were included

For many New Yorkers, rent constitutes by far their largest single expenditure per month, amounting to more than 35 percent of their paychecks on average. Yet, tenants almost never receive a benefit to their credit score from paying rent, while homeowners who pay a mortgage will see the benefits in their credit over time. In a recent report, Comptroller Scott M. Stringer analyzes how the addition of positive rent data - paying rent on time - to a consumer credit profile could establish and raise credit scores - and be beneficial to all: the renters, the landlords and property managers, and the overall economy.

"Credit scores can serve as a passport to the consumer economy, and individuals without credit scores or with low credit face severely restricted access to common financial services like loans, or markedly higher prices on insurance and credit card contracts," Stringer states in the report. "Giving renters the ability to have their hard earned rent check lift their credit scores can change the financial future for renters across the five boroughs."

The report, which is based on a sample of tenants paying less than $2,000 a month, predicts that 76 percent of them would see their credit scores improve if their rental payments were included.

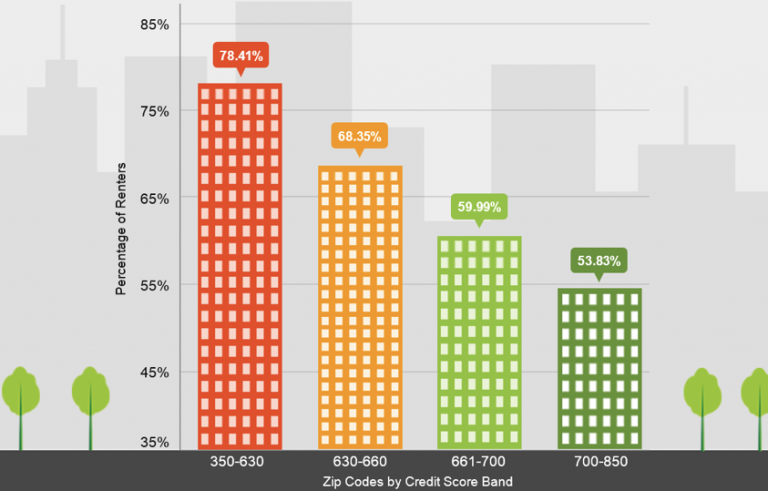

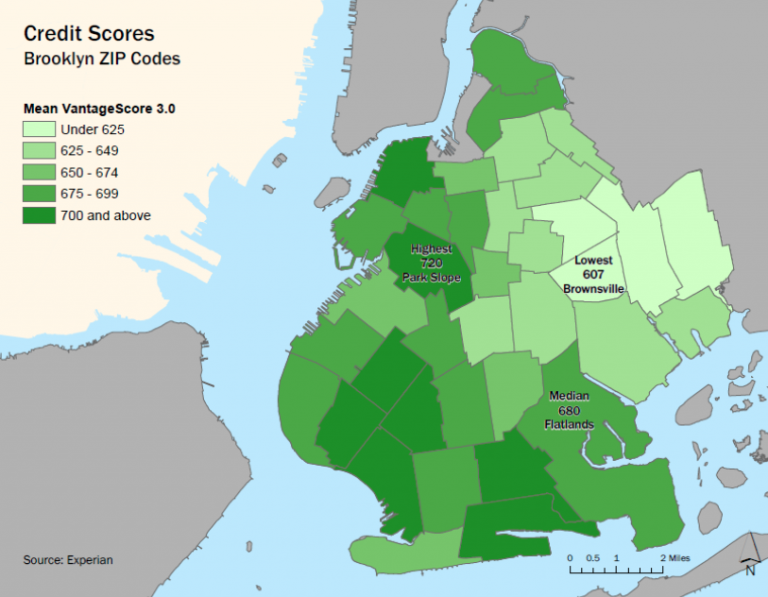

The Consumer Financial Protection Bureau (CFPB) estimates that approximately 20.8% of New York City adults either lack a credit file, have a thin or dated credit file and are categorized as credit "invisible," or "unscorable." Within zip codes with an average credit score of 630 or lower, Black and Hispanic residents account for over 90 percent of the population. Similarly, the average credit score for communities where NYCHA residents comprise one in ten residents is also under 630. The report estimates that 28.7 percent of them would gain a credit score for the first time, starting off with an average new credit score amounted to 700 points, a prime score. In comparison: The average score in the city is 673.

Stringer not only offers an analysis of the status quo but also presents a plan to expand efforts which couples new financial opportunities and consumer protections: empowering tenants to report their rent; encouraging landlords and property management companies to give tenants, especially low-income tenants, the ability to opt in to reporting their rent payments as a way to boost their scores; urging banks and credit unions to come up with strategies to report rent history to credit unions.

In Brooklyn, one pilot program is already underway: NYCHA is currently conducting an innovative pilot partnership with two credit unions, Brooklyn Cooperative Federal Credit Union and Urban Upbound Federal Credit Union, to give NYCHA residents the option to report their credit and to access to credit building devices.

Stringer emphasizes: "People who built up their communities deserve to stay in them. As we face an extraordinary affordability crisis, I believe this proposal will help."

To see the full report, go here.